Rapid Fire Idea #1: Cloudflare (NET)

NET – Strong Q1 beat and record-size deals showcase enterprise traction; FY-25 guide only tweaked, so all eyes stay on NRR lift and margin follow-through.

We are long NET.

The numbers (Q1-25)

Cloudflare closed its largest contract ever—“north of $100mm,” led by its Workers developer platform—and its longest-term SASE deal during the quarter.

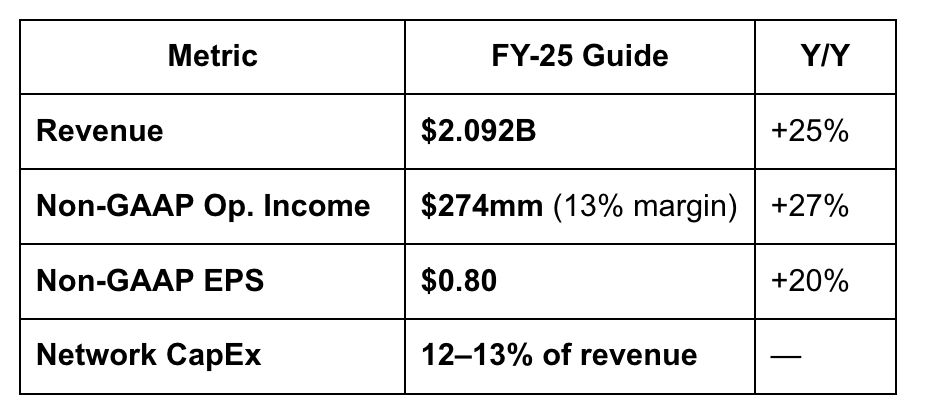

Guidance (non-GAAP)

Guidance is roughly in-line to a hair above prior Street consensus on EPS, but revenue is only nudged; management reiterated its 20 %+ LT op-margin / 25 %+ FCF-margin model.

Key takeaways

Enterprise land-and-expand is accelerating. Large-customer mix hit 69 % of revenue, and net new ACV grew at its fastest pace in three years.

Developer & AI flywheel keeps spinning. The triple-digit-million Workers contract and early multimillion-dollar Workers AI deal validate Cloudflare’s thesis that serverless + AI inference can be sold as infrastructure, not usage-based concessions.

Op leverage showing—but SBC still heavy. GAAP opex rose only 20 % vs. 27 % top-line, yet SBC was $106 m (22 % of rev.). Free-cash margin improved to 11 %.

NRR plateaued at 111 %. Expansion from existing customers is stable but no longer climbing; management points to better upsell pipeline in H2, helped by unified SASE bundles.

CapEx discipline beats peers. Network capex is guided to 12-13 % of revenue—half the level of some AI-infra players—underscoring Cloudflare’s commodity-hardware model.

Bull vs. Bear debate

Bulls

Mega‑deals prove platform reach. Fortune‑scale contracts show Cloudflare can bundle Workers, SASE, and security to win large budgets.

Margin runway intact. 77 % gross margin and disciplined capex support the path to 20 %+ operating margin.

Developer moat vs. hyperscalers. Neutral “connectivity cloud” resonates with customers wary of lock‑in.

Capex‑light AI edge earns premium. GPU‑at‑edge model monetizes AI without balance‑sheet strain. We believe this is the biggest bull-case driver and underappreciated by the market.

Bears

Growth leans on elephants. Reliance on outsized deals; NRR no longer climbing.

High SBC dilutes EPS. >20 % of revenue in SBC offsets free‑cash gains.

Crowded zero‑trust/SASE field. Heavyweights like Zscaler, Palo Alto, and Microsoft compete aggressively.

Valuation demands perfection. >12× FY‑26 EV/S; any growth wobble could compress multiples.

Our view

A clean beat driven by record enterprise contracts and still-healthy 27 % growth reinforces Cloudflare’s ability to sell broad platform bundles. Yet with NRR treading water and FY-25 revenue guide merely meeting expectations, the stock now needs sequential NRR lift and proof that big deals aren’t one-offs. If H2 shows sustained upsell momentum—and Workers AI margins hold—Cloudflare can justify its premium multiple. Otherwise, flat NRR plus rich SBC may keep bulls in check despite the enviable innovation pace.